CoBank featured at first ‘B2B Brunch’

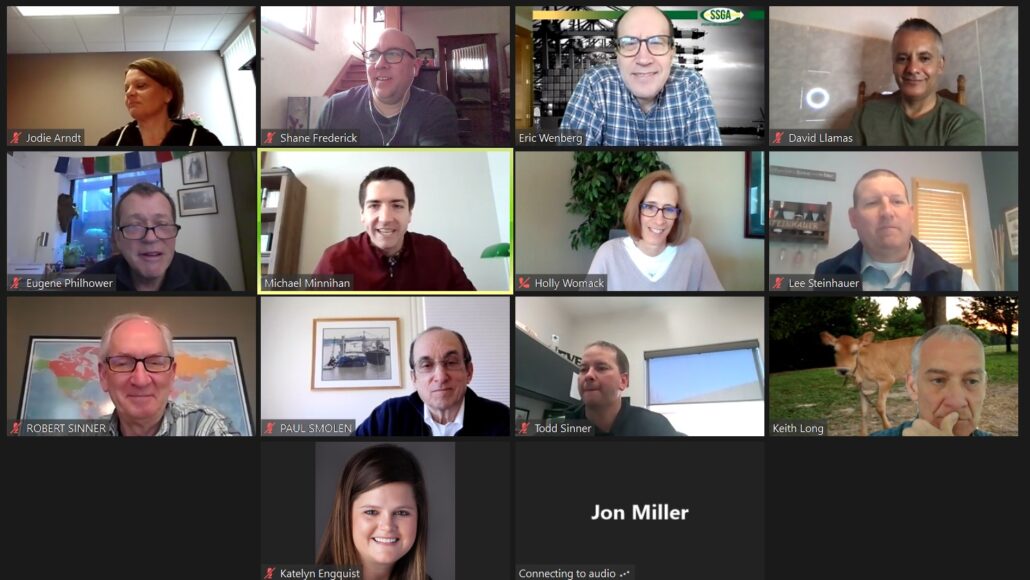

An hourlong conversation as robust as the mid-morning cups of coffee that went along with it took place online Friday, as the Specialty Soya and Grains Alliance (SSGA) premiered its “B2B Brunch.”

Michael Minnihan and Holly Womack of SSGA-member CoBank were the presenters for the first in what is planned to be a regular series organized to bring together SSGA members to network and learn from one another. Approximately 20 people attended Friday’s event.

Michael Minnihan and Holly Womack of SSGA-member CoBank were the presenters for the first in what is planned to be a regular series organized to bring together SSGA members to network and learn from one another. Approximately 20 people attended Friday’s event.

CoBank is the largest lender in the Farm Credit System, a broad-based cooperative financial services organization serving rural American agribusiness, communications, energy and water and community facilities. The cooperative is owned by approximately 2,400 customers and headquartered near Denver with regional offices and banking centers located througout the country.

Minnihan, a relationship manager for CoBank’s Regional Agribusiness Banking Group in Minneapolis, manages a portfolio of agribusiness customers in the Upper Midwest, primarily Minnesota, North Dakota, Wisconsin and Michigan, presented a CoBank overview and market update.

Minnihan said the outlook is “optimistic, at least short term, based on the opportunities that are present right now.”

“USDA has already told us there’s going to be record acreage for both corn and soybeans and wheat, across the board,” he said. “Producers, I think, are sitting in a pretty good spot. … I think markets have settled down quite a bit, but there’s still a lot of support.”

Womack, the lead relationship manager for the Agricultural Export Finance Division in Denver, presented on the work CoBank does as the leading provider of trade finance in support of U.S. agricultural products, including structured trade finance and taking an active role in electronic documentation capabilities such as letters of credit and collection.

“All we do is U.S. ag,” Womack said. “Unlike commercial bank competitors, CoBank only does agriculture. … And that runs the spectrum from the bulk commodities all the way down to the processed goods.”

In discussing the partnership between CoBank and SSGA, the presenters highlighted CoBank as a knowledgeable and dependable debt financing partner, its potential as a collaborator in agricultural export finance, and its ability to be conduit for networking in events such as the “B2B Brunch” and other meetings. They also featured CoBank’s Knowledge Exchange, a centralized site that includes reports and webinars by economists.

Leave a Reply

Want to join the discussion?Feel free to contribute!