Despite continued congestion, ports actually handling more cargo

Loaded exports continue to drag at key West Coast ports

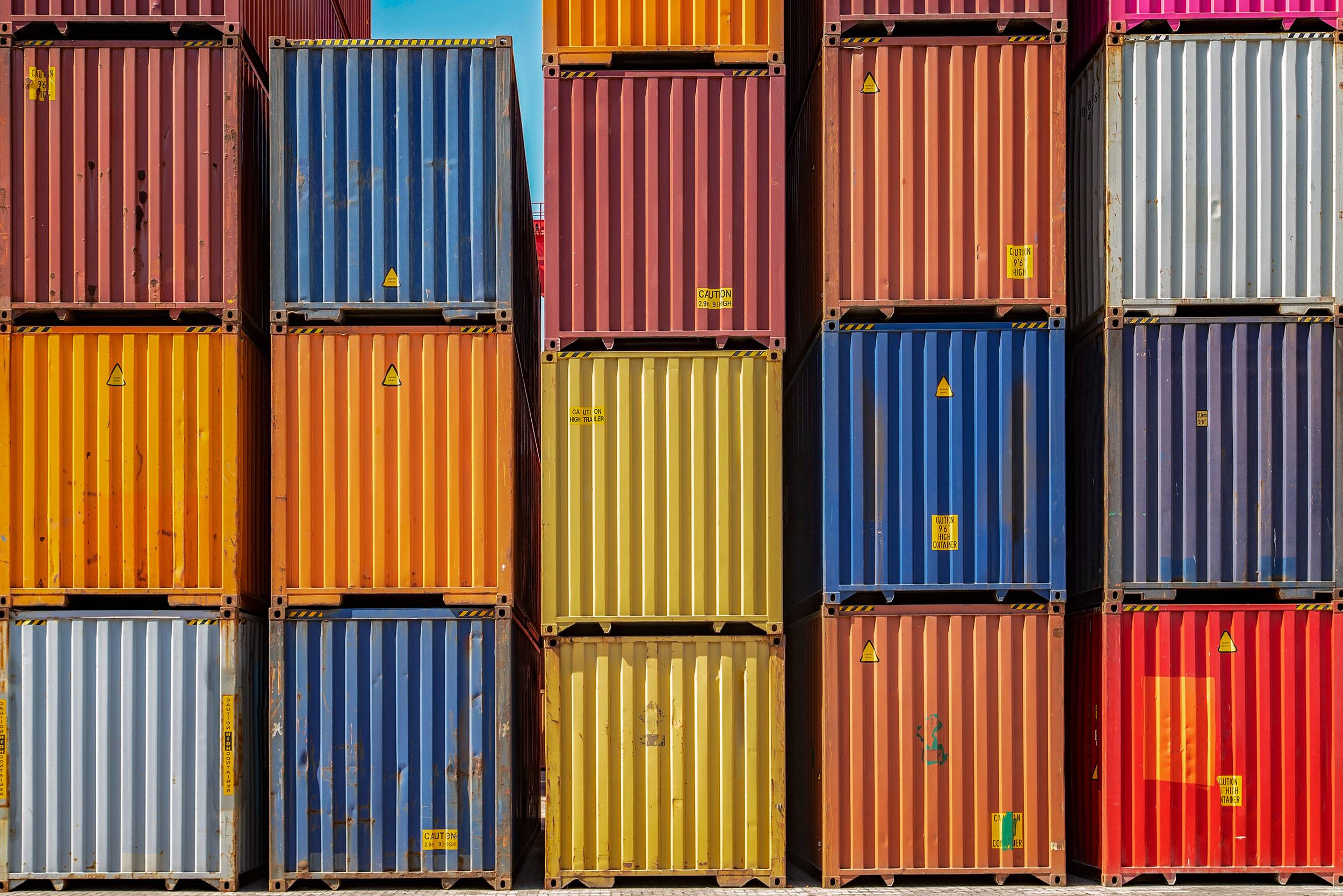

Hopes are on the rise that new efforts by the container ports and the supply chain partners that serve them, under pressure from the Biden Administration to adopt 24/7 or some level of increased hours of operation, will begin whittling back the backlog of containers stuck on the docks and ships parked offshore waiting to unload. However, the prognosis is not positive for a quick turn-around.

There was an estimated $22 billion worth of cargo stuck on container ships off the Southern California ports of Los Angeles and Long Beach less than a week ago, with 71 container ships waiting to unload on Oct. 20 with an average wait time to berth of 13 days, according to a Freightwaves report.

Meanwhile, up north at the Northwest Seaports Alliance-operated ports of Seattle and Tacoma, a backlog of ships parked offshore in Puget Sound reached 20 vessels. The Pacific Northwest ports, though, like the Southern California ports, report that they are handling more and more cargo, despite the congestion.

NWSA reports it handled 330,517 TEU of containers in September, up 7% from a year ago. Total volume from January through September was more than 2.8 million TEU, up 16%.

There are some wrinkles in the stats though.

NWSA, according to Container News, reported full import containers up 22.5% to 1,101,725 TEU. Yet, loaded exports declined by 11.4% to 522,767 TEU. The biggest shift was in shipment of empty containers back to Asia. Those hit 611,954, the largest increase by almost 50% at what traditionally have been strong U.S. export ports in past years with near balance in imports and exports.

More Tools Needed?

The Biden Administration successfully pushed labor and the Southern California ports to begin 24/7 hours of operation, while at the same time pressing major retail business leaders to keep warehouses open extended hours. Port of Los Angeles Executive Director Gene Seroka reported that there have been some improves in through-put already.

Other industry observers question if 24/7 operations can work with the shortage of truckers and the need for more rail capacity to move containers quickly inland and back. An American Journal of Transportation analysis notes Biden is tackling “the supply-chain crisis with few tools” while the “clock is ticking.”

The power of the U.S. government has some limitations to fix what is predominantly a private-sector program. Those limitations, particularly in the powers of the Federal Maritime Commission (FMC) are exactly what is on the minds of agriculture, manufacturing and retailing shipper interests – including SSGA.

The Ocean Shipping Reform Act, introduced in Congress, seeks to beef up FMC’s authority and oversight resources and capabilities.

‘Empties’ keep volume up

Despite chronic shortages of trucking availability nationwide and a growing imbalance in import, export and empty containers shipped from the West Coast, some industry analysts contend the U.S. global supply chain is not broken and, in fact, is handling more containers than ever before.

Freightwaves reported last week that the Port of LA had it’s busiest September ever, handling 903,865 TEU, up 2.3% from a year earlier, and 8,176,917 TEU for the year, up 26%. Its sister, the Port of Long Beach had its second-busiest September, handling 748,472 TEU for the month and 7,094,849 for the year, up 24.2%.

While loaded imports in September were flat at 468,059 TEU at LA, exports dropped a whopping 42% to just 75,714 TEU, Seroka and the port reported. Seroka, long a strong advocate for increasing U.S. ag exports, said that was the lowest number of exports handled in a month since 2002. Empties shipped out make for the largest gains, up 28% to 360,092 TEU. Long Beach saw imports decrease 8.7% in September compared to a year earlier at 370,230 TEU, and exports shrank 1.6% to 110,787 TEU. Empties were 267,456 TEU.

Jason Miller, a supply chain logistics associate professor at Michigan State University, however, contends that America’s supply chain is actually performing well – given the extreme circumstances that exist now.

He points out in a separate analysis piece in Freightwaves that America’s warehouses, where all the containers handling imports move to, are concentrated in just a small number of select markets that are currently preferred by importers – places like Southern California, inland cities such as Chicago, Kansas City and Dallas, as well as near East Coast port population centers.

The lack of trucking, related lack of chassis and shortage of workers in those particular markets, he contends, coupled with a whipsaw change in consumer demand, are largely to blame for the congestion dilemma the country is experiencing. He also cites data that show retail sales and movement of goods is up. The supply chain – at least the import supply chain – is not broken, Miller contends.

Compiled by Bruce Abbe, SSGA Strategic Advisor for Trade & Transportation

Leave a Reply

Want to join the discussion?Feel free to contribute!