By Bruce Abbe

Precision scheduled railroading (PSR). Some feel it will be a boon for the railroads by improving efficiencies and lowering costs. Yet, it’s been a boondoggle for many rail shippers so far over the last three years that it’s been implemented in one form or another by more class one railroads.

Time will tell if PSR will live up to the promises railroads have been making. More observers, including some shippers, are coming around to the idea that maybe service will eventually improve, while others believe it will be the cause of uneven and deteriorating service for different rail shippers and it’s not the right route for rails to travel.

U.S. House transportation hearing

On July 25, a U.S. House Transportation and Infrastructure subcommittee held a roundtable in Washington, D.C., to hear from rail shipper customers and industry associations to highlight challenges faced by farmers, manufacturers and energy companies whose rail service have been impacted by precision scheduled railroading.

Perhaps the overriding complaint was the lack of collaboration between the railroads and their customers when they set out to redeploy their physical assets: rail cars, engines and related equipment, and reduce their labor needs and costs while pursuing leaner, streamlined service.

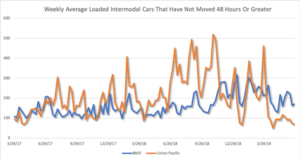

The shippers also voiced strong complaints about service delays and hiccups when PSR is initially implemented that led to them to get hit with skyrocketing overcharges for demurrage and storage of rail cars that they believe is solely the responsibility of the railroads.

PSR got its start and name under the late Hunter Harrison several years back when he took the helm of Canadian National (CN) railroad and embarked on a fierce cost cutting program, shedding assets and service frequency while pursuing increased fluidity. Some believe the changes were necessary. Operating profit improved, but service took a hit. After Harrison left CN, the new administration set about restoring service and trying to rebuild a reputation for doing so.

After hedge fund investors took control of CN’s main competitor, Canadian Pacific (CP) railroad, Harrison was brought on as CEO and set about leaning up CP’s operations while emphasizing the more lucrative long haul with unit trains. CP even sold off assets, including engines at a time when the Bakken Oil Field boom was taking place and its main U.S. competitor, BNSF railroad, was adding equipment to meet oil and frac sand shipping demand. After the hedge fund investors sold off their stock and Harrison departed, CP’s new management has been working to restore service levels and take back some of the intermodal business it had lost to CN.

Harrison next came out of retirement to take over leadership at CSX, one of the two main class one, eastern U.S. railroads. CSX moves to cut and reform its operations proved to be more difficult in the more fragmented geography the railroads in the East tend to operate on, and many shippers were irate and fearful of losing service. The U.S. Surface Transportation Board (STB) heard numerous complaints and engaged CSX on its PSR steps.

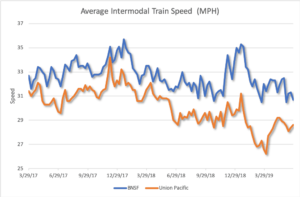

More recently, Union Pacific (UP) railroad, the largest U.S. railroad that serves the western half of the country embarked on its version of PSR, rolling out a range of operational changes, including eliminating some “hump yards” that switch rail cars between rail lines and trains where it was believed operations can be sped up without them.

Intermodal container service, generally less impacted by PSR operational reforms, did undergo changes by UP when it announced it would discontinue managing the interconnecting handoff of containers shipped west to east and back requiring a connection to an eastern railroad. Shippers or their logistics firm providers will need to manage trucking containers from UP rail yards on the west side of Chicago to a CSX or Norfolk Southern rail terminal on the east side of the Chicago metro area.

MARS conference examines PSR

In truth, PSR is a very general term and is different from one railroad to the next in terms of how it is executed.

PSR and its impact on shippers was the focus of the Midwest Association of Rail Shippers (MARS) annual summer meeting two weeks ago attended by the Specialty Soya and Grains Alliance (SSGA) staff.

Keynote speaker James Squires, president and CEO of Norfolk Southern (NS) railroad, told the large crowd of rail shippers that NS chose to hold back and watch how PSR was executed by other railroads and is taking a different approach.

“The chainsaw method…” to PSR doesn’t work. NS, he said, has adopted a different approach by engaging and involving its shipper customers in planning its version of precision scheduled railroading. He believes it is paying off and will yield benefits for both the railroad’s operating bottom line and shippers in the resulting efficiencies.

A panel of four major, large volume rail shippers that work with more than one railroad had a bit different story about their experiences with PSR.

Rob Cook, senior manager of rail operations at Bunge, noted the supply of rail cars got so pinched down during PSR implementation they had to bring on their own supply of cars when the rails reduced the cars they would supply. Customer support was lacking.

Another manufacturer shipper was concerned about the break up of the large unit trains they had geared their operations to serve. Their customers were used to handling the larger trains.

Precision scheduled railroading “is not very precise” at destinations and origins – that last mile of service” – said another shipper. Customer service was bad. Local crews were reduced.

Few people understood the “accessorial” and demurrage charges that the railroads began to charge. When the group was asked what could be done to make PSR better, Cook said he’d like to see “reverse demurrage,” whereby the railroad had to pay when its equipment didn’t show up on time when ordered.

All of the shippers urged more collaboration in planning a major overhaul of rail operations.

The first three months of PSR implementation was described as “chaos” by more than one shipper, but improved after three months. The general prediction was after one year of adjustment operations will be better and the results better known.

BNSF takes a different track

Precision scheduled railroading also frequently came up at the MARS winter meeting in Chicago in January 2019. Matt Rose, BNSF’s long serving chairman and CEO, was honored at that event for his service leading the other main western U.S. class one railroad, which had led the way in terms of continuing to reinvest profits into the track, assets and operations. Rose was asked during a sit-down keynote interview what he thought of PSR. BNSF has rejected that approach, Rose said emphatically. Operations at BNSF are continually evolving but finding a way to expand and improve service should be the priority focus for the long term, rather than embarking on any whole-sale slashing of operations in the name of efficiency.

Let SSGA know your thoughts

SSGA would like to hear from any members who have felt the impact of any PSR rail operational reforms affecting your business, or if you have views or news about rail service that we should know about. Contact Bruce Abbe at bruce@abbecommunications.com or Eric Wenberg at ewenberg@soyagrainsalliance.org

Bruce Abbe is the Strategic Advisor for Trade and Transportation for SSGA. Reach Bruce at 952-253-6231 or drop him a line here.