With about 80% of Identity Preserved soybeans and specialty grains being exported out of the United States and 50% of those exports going to Japan for high-quality food products, it’s vital that U.S. processors continue to maintain good relationships and open communications with food manufacturers in Japan.

“It’s no secret: Japan has been and continues to be the star for U.S. suppliers,” said Bob Sinner, president of SB&B Foods and chairman of the Specialty Soya and Grains Alliance. “Our relationship with Japan speaks for itself, and relationships mean something. We need to continue to address the issues that are important to both of us. … Open dialog is always good.”

Sinner made his remarks during an online meeting last week between SSGA board members and staff and representatives from Japan’s embassy in Washington, D.C. – Tatsumasa Miyata, counselor for agriculture, forestry and fisheries; and Ryo Tsuzukihashi, first secretary agriculture attaché for the embassy.

SSGA was represented by Sinner, Vice-Chairman Rob Prather, Secretary/Treasurer Darwin Rader and board members Adam Buckentine and Raquel Hansen, along with Executive Director Eric Wenberg, Technical Adviser for North Asia Alyson Segawa and SSGA staff Lee Steinhauer and Shane Frederick.

SSGA was represented by Sinner, Vice-Chairman Rob Prather, Secretary/Treasurer Darwin Rader and board members Adam Buckentine and Raquel Hansen, along with Executive Director Eric Wenberg, Technical Adviser for North Asia Alyson Segawa and SSGA staff Lee Steinhauer and Shane Frederick.

“We’re super thankful for Japan’s partnership in this business,” said Prather, chief strategic ambassador for Global Processing. “Without it, I don’t know where the business would be right now. It’s a very solid relationship.”

The meeting, conducted via Zoom, gave SSGA representatives a chance to provide a pre-harvest update on the 2021 crop as well as an outlook on what’s ahead for 2022. The heart of the discussion, however, centered on the container shipping difficulties that continue to disrupt the global supply chain. The crisis has resulted in higher freight charges and other costs, crippling congestion and interruption in and out of the ports and logistical difficulties in getting containers to exporters of agricultural products located throughout the United States.

The problem is one that has plagued U.S. Identity Preserved exporters for more than 18 months, putting stress on those processors and their staffs. It was made clear that transportation is one of the issues that companies on both sides of the Pacific Ocean agree must get resolved as quickly as possible.

“The transportation issue is most important for food security,” Miyata said, noting that most of Japan’s food is imported from the United States. “Container prices have skyrocketed, and it’s difficult for us to import U.S. grains and U.S. foods.”

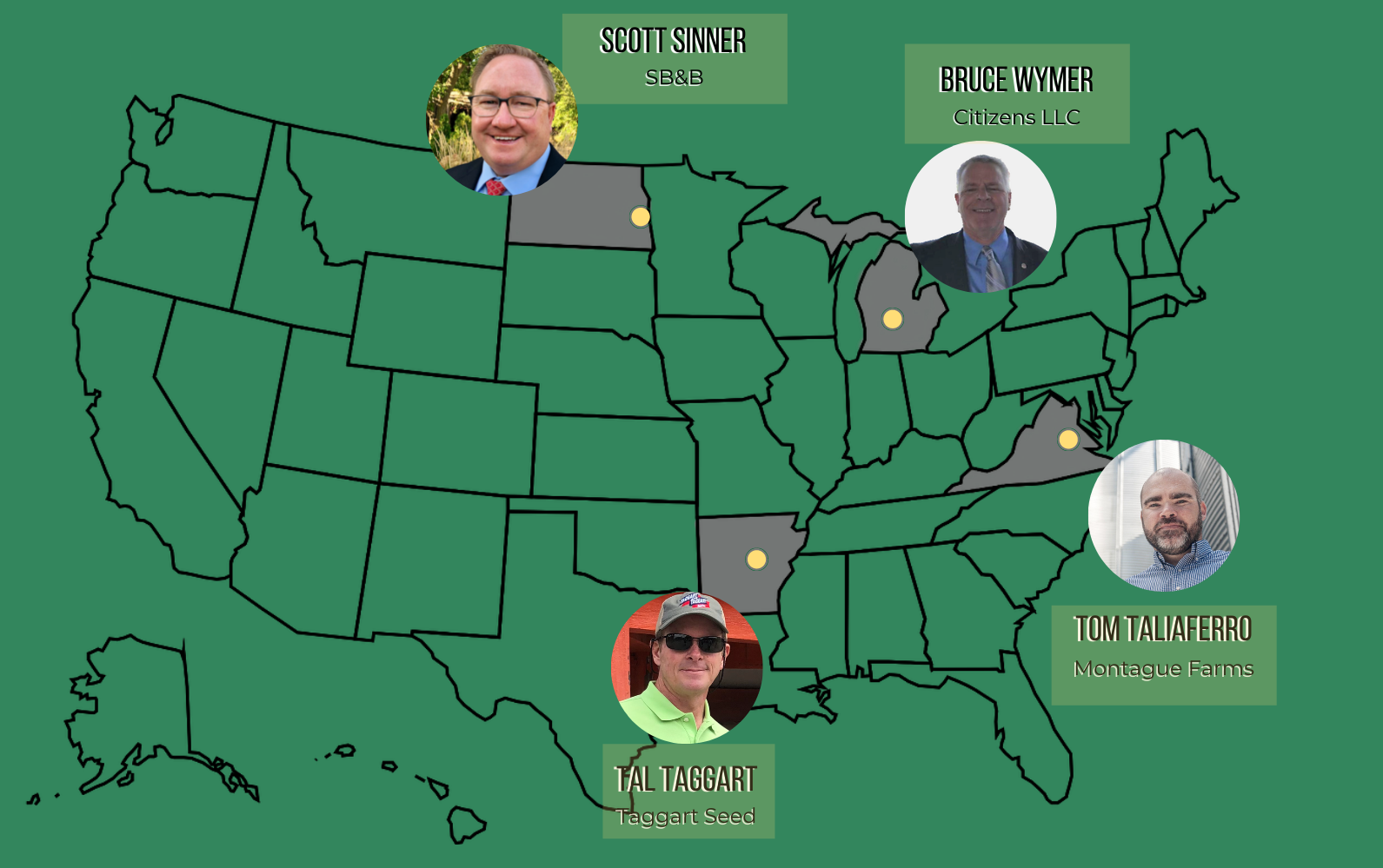

Besides sharing information on the shipping challenges, SSGA’s board members, who represent a wide swath of the United States’ Identity Preserved growing region discussed this year’s crop, which is beginning to be harvested. Growing conditions have ranged from very dry to ideal to wet, depending on the location, so there’s expected will be a wide range of productivity.

“We are geographically diverse,” Wenberg said, “and our states are geographically diverse.”

Looking ahead to 2022, the message from the U.S. Identity Preserved industry to Japanese buyers (and others around the globe) is, as always: Plan ahead. Advance contract, especially with inflation expected to continue across all inputs.

“We already have our programs set,” said Rader, international sales manager for Zeeland Farm Services. “When the ’21 crop comes in, that’s when we start contracting for ’22.”

SSGA reiterated its gratitude to Japan for its decision in spring of 2020 to delay implementation of its phytosanitary requirement until 2023.

“We want to ensure that we work with Japanese importers and offer support where we can for compliance,” Segawa said. “SSGA wants to be a good partner.”

The embassy officials asked that SSGA continue to promote and educate buyers on the Identity Preserved system. SSGA will be unveiling an IP assurance protocol and related brandmark later this year.

SSGA will participate in a natto update with Japanese natto producers on Dec. 9. It will be an opportunity for continued open dialog between U.S. exporters and manufacturers of the traditional Japanese food made from fermented soybeans and popular for its health benefits.

Following their visit with Vinasoy, a Vietnamese soymilk and soy drink producer, Huynh believes the prospect of Vinasoy importing U.S. Identity Preserved soybeans to be high. Vinasoy staff recently returned from the Food Grade Soybean Procurement Course at Northern Crops Institute in Fargo, N.D. Prather and Huynh also met with Dabaco, a feed and food production company and have more visits planned.

Following their visit with Vinasoy, a Vietnamese soymilk and soy drink producer, Huynh believes the prospect of Vinasoy importing U.S. Identity Preserved soybeans to be high. Vinasoy staff recently returned from the Food Grade Soybean Procurement Course at Northern Crops Institute in Fargo, N.D. Prather and Huynh also met with Dabaco, a feed and food production company and have more visits planned. SSGA had the opportunity to weigh in on that concern during the conference, hosted by the U.S. Soybean Export Council (USSEC) June 21-22 in Bali. Presenting virtually, SSGA Executive Director Eric Wenberg and Chair Rob Prather briefed about 150 attendees on current identity preserved (IP) crop production issues, logistics and container shipping during the hybrid event. Steve Peach, a Michigan farmer and member of the Michigan Soybean Committee, and Troy Berndt, a grower relations specialist in Wisconsin, updated attendees on the 2022 growing season in their respective states/regions.

SSGA had the opportunity to weigh in on that concern during the conference, hosted by the U.S. Soybean Export Council (USSEC) June 21-22 in Bali. Presenting virtually, SSGA Executive Director Eric Wenberg and Chair Rob Prather briefed about 150 attendees on current identity preserved (IP) crop production issues, logistics and container shipping during the hybrid event. Steve Peach, a Michigan farmer and member of the Michigan Soybean Committee, and Troy Berndt, a grower relations specialist in Wisconsin, updated attendees on the 2022 growing season in their respective states/regions. The event was held in coordination between SSGA, the U.S. Soybean Export Council (USSEC) and the China Chamber of Commerce of Import and Export of Foodstuffs, Native Produce and Animal By-Products (CFNA).

The event was held in coordination between SSGA, the U.S. Soybean Export Council (USSEC) and the China Chamber of Commerce of Import and Export of Foodstuffs, Native Produce and Animal By-Products (CFNA). The petitioners in the case were the Organic Soybean Processors of America (OSPA) and the following processors: American Natural Processors LLC (S.D.), Organic Production Services LLC (N.C.), Professional Proteins Ltd. (Iowa), Sheppard Grain Enterprises LLC (N.Y.), Simmons Grain Co. (Ohio), Super Soy LLC (Wis.) and Tri-State Crush (Ind.).

The petitioners in the case were the Organic Soybean Processors of America (OSPA) and the following processors: American Natural Processors LLC (S.D.), Organic Production Services LLC (N.C.), Professional Proteins Ltd. (Iowa), Sheppard Grain Enterprises LLC (N.Y.), Simmons Grain Co. (Ohio), Super Soy LLC (Wis.) and Tri-State Crush (Ind.). Newly elected SSGA Chairman Rob Prather was a co-chair for the virtual session and also presented on buying Identity Preserved field crops from the United States. SSGA Manager of Strategic Programs Shane Frederick then presented on the new U.S. Identity Preserved Assurance Plan and brand mark, which was launched on Dec. 2, and SSGA University.

Newly elected SSGA Chairman Rob Prather was a co-chair for the virtual session and also presented on buying Identity Preserved field crops from the United States. SSGA Manager of Strategic Programs Shane Frederick then presented on the new U.S. Identity Preserved Assurance Plan and brand mark, which was launched on Dec. 2, and SSGA University. The update was an opportunity to share information, including 2021 post-harvest crop conditions and an outlook for 2022. Presenters represented different companies in different regions of the United States.

The update was an opportunity to share information, including 2021 post-harvest crop conditions and an outlook for 2022. Presenters represented different companies in different regions of the United States. SSGA was represented by Sinner, Vice-Chairman Rob Prather, Secretary/Treasurer Darwin Rader and board members Adam Buckentine and Raquel Hansen, along with Executive Director Eric Wenberg, Technical Adviser for North Asia Alyson Segawa and SSGA staff Lee Steinhauer and Shane Frederick.

SSGA was represented by Sinner, Vice-Chairman Rob Prather, Secretary/Treasurer Darwin Rader and board members Adam Buckentine and Raquel Hansen, along with Executive Director Eric Wenberg, Technical Adviser for North Asia Alyson Segawa and SSGA staff Lee Steinhauer and Shane Frederick.