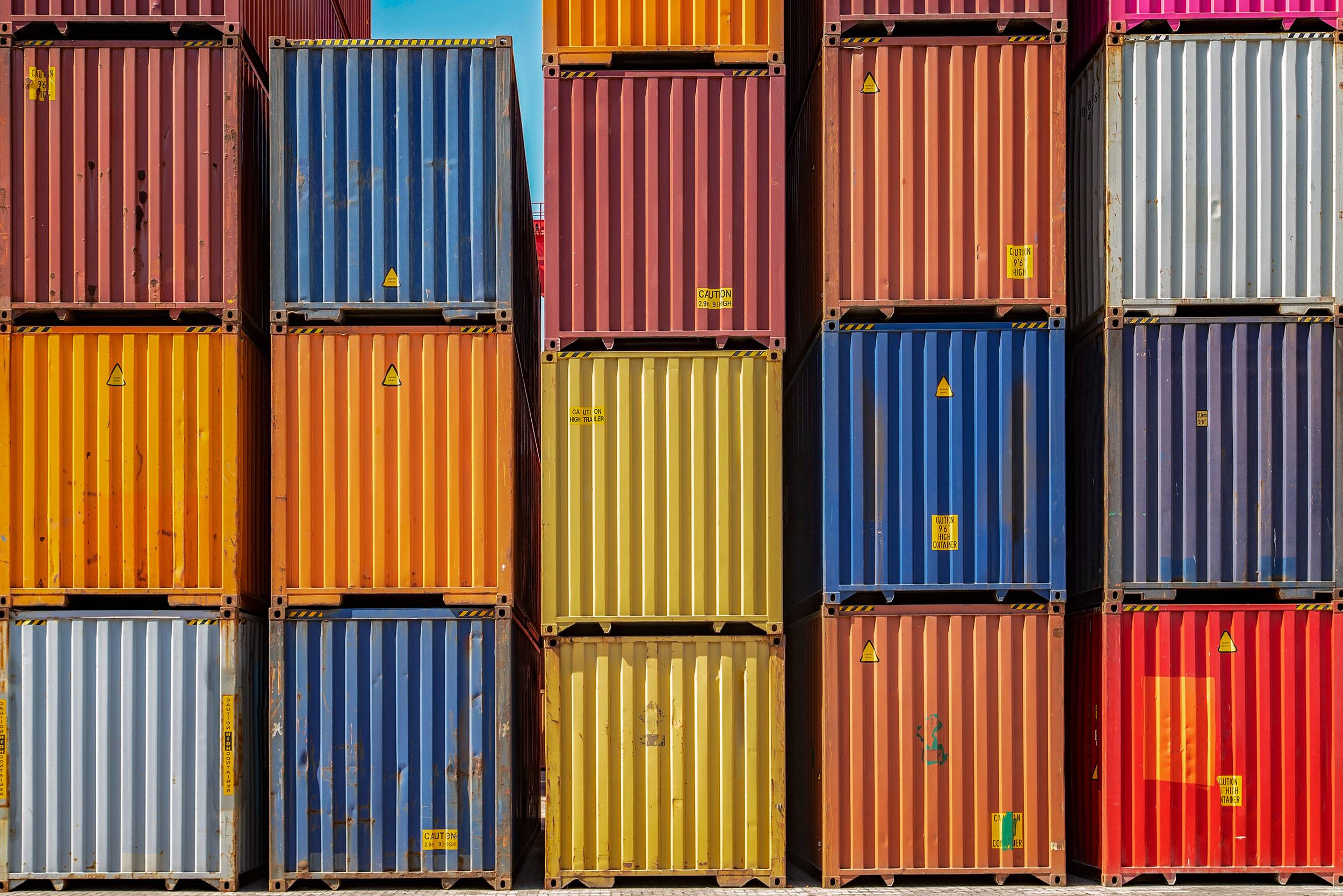

Competitive Shipping: Container, booking problems persist

Compiled by Bruce Abbe, SSGA Strategic Adviser for Trade and Transportation

There seems to be little, if any, let-up in the extraordinary imbalance of global container flow and supply chain congestion. The crisis, which is more than six months long and running, has constricted the export capabilities of U.S. agriculture container shippers to a trickle. In fact, some market analysts saying “the worst may yet be to come.”

Here is a roundup of the latest transportation news:

- “Empty-container rush signals worst yet to come for shipping community” is the headline of a Freighwaves story over the weekend. The report noted that last month, for the first time in history of a rail container volume index, more nonholiday empty containers headed back to Los Angeles from inland than loaded ones.

The maritime ocean carriers control and govern the flow of containers. Ever–increasing demand for durable goods made in Asia and imported to North America keeps driving up rates for the eastbound Trans Pacific. The shortage of available containers in Asia is driving carriers to continue to ship empties back “neglecting (the needs) of U.S. exporters.”

Maritime Market Expert Henry Byers was quoted about the surge in empties and what it signals for shippers, “It’s time to sound the alarms,” maritime market expert Henry Byers said in the story. “The shortage of container capacity is already affecting many supply chains, but almost no company will be spared from what lies ahead.”

- In“Container congestion not going away as supply chains stressed beyond the max,” a research report by the data and media firm Panjiva, Federal Maritime Commission Chair Daniel Maffei said an “import boom” has “stressed our supply chain to the max and beyond”—up 50.6% year-over-year in March.

- Asian container availability is tightening, and the purchase and rental costs of the steep shipping boxes are soaring, according to the ContainerXChange online data platform, the Journal of Commerce reported last week. The container ocean lines “warn that equipment will become even scarcer in the eastbound Trans Pacific as demand builds through May.” Delayed impact of the Suez Canal closure is apparently still affecting the system, causing experts to predict transportation markets and equipment availability will tighten further in the coming weeks.

- As SSGA has noted previously, it’s not just an issue for North America and North Asia. “Box shortages and port congestion now an ‘industry wide challenge’ across Asia,” reported The Loadstar, citing communication from Maersk, and the equipment shortages will get worse over the next two weeks. Schedule reliability will continue to be impacted negatively.

- Import retailers and ocean carriers are beginning to shift some of their import volumes to ports than the congested southern California ports of Los Angeles and Long Beach. Oakland, the Northwest Seaport Alliance, New York/New Jersey and Savannah are seeing some gains. Yet all of the major ports are experiencing some degree of operational issues, JOC reported. Maersk and Mediterranean Shipping Company (MSC) are among carriers making shifts in their service routings.

Blockbuster ocean carrier earnings, contract rate increases getting reported

- While their customers are facing unprecedented equipment shortages and high rates, the ocean carriers are reporting unprecedented profits, after years of losing money due to what until recently was over-capacity.

Hong Kong-headquartered carrier OOCL reported “spectacular” increases in volume and revenue last week for the first quarter 2021, according to Loadstar. Average revenue per container increased 58.3% year-over-year. A 28.3% increase in volumes led to a provisional first–quarter revenue total of $3 billion, up 96% from the same period in 2020, which, it should be noted, was the start of the pandemic and a series of reduced sailings by the carriers. Revenue from the Trans Pacific rose 84.9%, just topping $1 billion.

- It should not go unnoticed that the tightening container availability and capacity forecast for May are happening at the key time when beneficial cargo owning shippers and freight forwarders are renegotiating contracts for the coming year. Container-News.com reports some shippers are paying double and up to three times as much as last year in rate increases on major trade lanes.

CN takes on CP in competition to acquire KCS

Canadian Pacific Railway’s recent surprise announcement of a public offer to buy fellow class one railroad Kansas City Southern (KCS), and expand its network connections to take advantage of the U.S./Canada/Mexico trade agreement certainly caught the eye of CP’s erstwhile northern competitor Canadian National Railway Company (CN).

Last week, CN President and CEO J.J. Ruest sent a public offer to KCS President and CEO Pat Ottensmeyer and the KCS board offering to match the CP offer “Letter for Letter,” according to Railway Age. CN has also submitted a “pre-file” of its offer with the U.S. Surface Transportation Board (STB) for consideration. The STB will be examining the proposed acquisition for anti-competitive and service consideration for the market.

Leave a Reply

Want to join the discussion?Feel free to contribute!